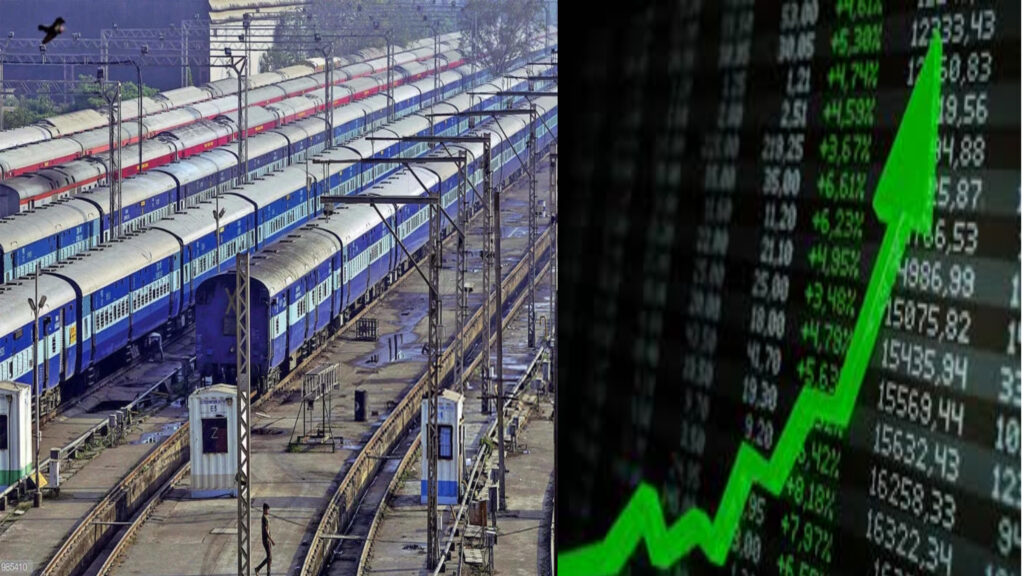

Railway stocks experienced a significant surge, with companies like Indian Railway Finance Corporation (IRFC), Rail Vikas Nigam (RVNL), Ircon International, Jupiter Wagons, Titagarh Rail Systems, and Texmaco Rail & Engineering witnessing up to a 19% increase in their value on Monday, anticipating Budget 2024. IRFC shares, for instance, reached an all-time high of Rs 134.5, marking a 19% increase, with 33.66 crore shares worth Rs 4,291.5 crore changing hands.

The remarkable performance of IRFC is evident in its month-on-month growth of 41.3%, a staggering 311% surge over the past six months, and an impressive 465% rise over the last two years. In contrast, the benchmark Sensex showed a more modest increase of 2.4% in the past month, 10.83% over the last six months, and 203.2% in the past two years.

RVNL shares also experienced a boost, rising by 13.5% to hit a new 52-week high of Rs 230.6. The counter witnessed a transaction of 10.16 crore shares worth Rs 2,240.3 crore. RVNL’s upward trajectory includes a 23.1% increase in the past month, an 88% surge over six months, and an impressive 520% rise in the last two years.

In a report, Prabhudas Lilladher highlighted India’s transformative phase, emphasizing massive infrastructure development, defense initiatives, production-linked incentives (PLI), and a substantial increase in domestic demand. The report underlines the country’s focus on areas such as highways, logistics, ports, railways, and metro systems.

Other railway stocks followed suit, with Jupiter Wagon hitting a 5% upper circuit at Rs 371.6. Titagarh Rail Systems shares rose by 3.5%, while Ircon International jumped 7.5%, reaching a 52-week high of Rs 209.7. Texmaco Rail & Engineering rallied by 6.2%, hitting a 52-week high of Rs 193.5 amid heavy volumes on the BSE.

Vivek Lohia, Managing Director of Jupiter Wagons, expressed anticipation for the upcoming budget, emphasizing the industry’s vision for a robust railway network. Lohia highlighted expectations for the budget to address congestion issues, strategic planning, and support for indigenous manufacturing. The aim is to contribute to a resilient and self-reliant Bharat, building on the postulates of the previous year.

Texmaco Rail & Engineering saw a 3.7% increase in its stock, trading at Rs 189 on BSE at 1:30 p.m. The stock has demonstrated remarkable growth, surging by nearly 135% in the last six months and an impressive 380% over the past two years.

The positive momentum in railway stocks is a reflection of the broader economic landscape, with investors showing confidence in the transformative initiatives and developmental projects underway in India. The focus on infrastructure development, coupled with government support and favorable budget expectations, has contributed to the significant uptick in the railway sector.

As the anticipation for Budget 2024 builds, market participants are closely monitoring signals and announcements related to the railway sector. The surge in stock prices indicates a positive sentiment, with stakeholders optimistic about the government’s continued commitment to fostering growth in the railway industry and the overall economic landscape.

In conclusion, the recent rally in railway stocks underscores the market’s confidence in India’s developmental trajectory, particularly in sectors crucial for the nation’s infrastructure. The upcoming budget holds the key to further shaping the landscape for these stocks, and investors are keenly observing for policy measures that could impact the railway sector positively.