Improve CIBIL Score:

When you go to take a loan from the bank or apply for a credit card, your credit score i.e. your CIBIL Score is seen. The higher your CIBIL score, the better it will be for you because due to low CIBIL score, you may face a lot of difficulty in getting a loan from the bank as well as getting a credit card.

If you do not know about CIBIL Score, then let us tell you that CIBIL Score or Credit Score is a number which is based on your credit history i.e. when you have taken a loan from which bank, whether you have repaid the loan amount on time or not. Address is done through numbers. Today we will tell you about some ways to increase your CIBIL score, through which you can increase your CIBIL score quickly.

How to increase your CIBIL score quickly

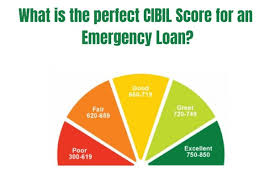

If your CIBIL Score is low and you want to increase your CIBIL Score, then you can increase your CIBIL Score very easily. CIBIL Score ranges between 300 to 900 and if you follow the opinion of any expert then your CIBIL Score must be above 700.

If your CIBIL score is above 700, it will be easy for you to get a loan from the bank. Also, if you apply for a credit card, your application will also be approved soon. A good CIBIL Score not only helps in getting a loan but also helps a lot in getting a loan at low interest. Let us know about the ways to increase CIBIL score –

1) You must check your CIBIL Score timely, and if you see any transaction statement in your credit history that has not been done by you, then you should report it as soon as possible because wrong transactions can also Our CIBIL score may go down.

2) If you have a credit card, then you should always pay your credit card bills timely because if you are late in paying the credit card bill, then late fee will be charged and your CIBIL score will also be affected due to late fee. It may be less, that is why it is important for you to pay your bills on time.

3) If you have any loan going on in the bank then it is important for you to repay your bank loan on time and also you can try to repay the loan amount before time because if you repay your loan before the deadline. If you fill it earlier then your CIBIL score can also increase.

4) If you have 1 or 2 credit cards, then you should never apply for more credit cards because this can also reduce your CIBIL score.

5) You get a limit in your credit card, never use the entire limit given in your credit card, you should use only 50% of your credit limit or less.

We have told you all about all the methods of increasing CIBIL score above, if you use those methods properly then you can increase your CIBIL score above 700 within 1 to 2 months.

Check your CIBIL score in this way

You must have known about the method of Improve CIBIL Score, but if you do not know how to check CIBIL Score, then let us tell you that you can check your Credit Score through your mobile number and PAN Card from the CIBIL.com site. Can check. If you want, you can check CIBIL score not only through Cibil.com website but also through payment apps like Paytm, GPay, PhonePe.

Improving your CIBIL score involves several steps. Here are some tips to help you boost your score:

1. Pay Bills on Time:

- Timely payment of credit card bills, EMIs, and loan installments is crucial. Late payments can significantly impact your score negatively.

2. Reduce Credit Utilization Ratio:

- Try to keep your credit utilization ratio low. Aim to use only 30-40% of your available credit limit.

3. Don’t Close Old Accounts:

- Keep older accounts open as they demonstrate a longer credit history, which is beneficial for your score.

4. Regularly Check Your Credit Report:

- Monitor your credit report for errors or inaccuracies. Dispute any discrepancies to rectify them.

5. Diversify Credit Mix:

- Having a mix of credit types like credit cards, loans, etc., can positively impact your score, showcasing your ability to handle different kinds of credit responsibly.

6. Limit Credit Inquiries:

- Multiple hard inquiries in a short period can negatively affect your score. Try to limit these inquiries, especially when applying for new credit.

7. Maintain a Stable Credit History:

- Avoid frequently opening or closing credit accounts as it can affect the average age of your accounts.

8. Pay Off Debts:

- Work on paying off existing debts to reduce your overall debt burden, which can improve your credit score.

9. Use Credit Responsibly:

- Responsible and disciplined credit usage over time builds a positive credit history and improves your score.

10. Seek Professional Help if Needed:

- If you’re struggling to manage your debts or improve your score, consider seeking guidance from financial advisors or credit counseling services.