Skip to content

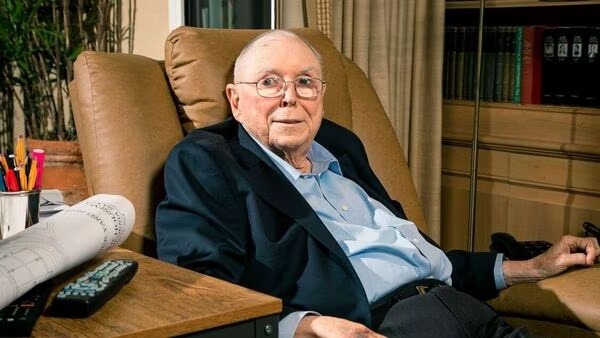

Charlie Munger would have turned 100 years old today. Although he came close to reaching this century, it remained just out of reach, as he departed from us on November 28, 2023. The renowned investor left behind an extensive legacy detailing the essential factors behind his success, presented in his distinctive style characterized by straightforwardness and humor.

Who exactly was Charlie Munger? This individual collaborated with Warren Buffett to transform Berkshire Hathaway Inc. into a formidable global investment entity. Munger, a prolific speaker, frequently delved into extensive discussions on investment strategies. His comprehensive principles of investing are widely deliberated upon by both novice and seasoned investors across the globe.

Munger’s investing principles encompass a mixture of rationality, psychology, and a broad curiosity that extends beyond finance, offering applicability to various facets of life. Below are some of his crucial principles.

Mr Market: Exercise caution amidst his fluctuating moods

Munger frequently employs the metaphor of Mr Market, portraying him as a manic-depressive entity consistently presenting opportunities to buy or sell a share in a business. In moments of euphoria, Mr Market may propose prices well beyond the intrinsic value of the business. Conversely, during periods of gloom, he might practically give it away. The crucial approach is one of patience and discipline, choosing to buy only when Mr Market offers a bargain and selling when his actions become irrational.

Adhere to your area of expertise

Munger advocates for investors to concentrate on domains where they possess a profound understanding of the businesses and the competitive environment. This “circle of competence” is cultivated through years of study and hands-on experience. By adhering to your expertise, you enhance your ability to recognise undervalued opportunities and steer clear of potentially expensive errors.

Seek businesses with enduring competitive benefits

Munger loves businesses with “economic moats,” sustainable competitive advantages that protect them from their rivals. These moats can come in many forms, such as strong brands, network effects, or regulatory barriers. Businesses with wide moats are more likely to generate high returns on capital over the long term.

Incorporate a safety cushion

Even the most skilled investors are prone to errors. Hence, it is crucial to incorporate a margin of safety when making investment choices. This involves acquiring stocks at a considerable discount to their intrinsic value, ensuring that profitability persists even if your analysis proves incorrect.

Avoid the herd mentality

One of Munger’s most famous quotes is “All I want to know is where I’m going to be wrong”. He emphasized the importance of independent thinking for success in investing. Refrain from blindly following the crowd; instead, conduct your research and draw your conclusions.

Acknowledge your personal biases

Investors are equally prone to psychological biases as individuals in any other field. Munger advises investors to recognise their own biases and take measures to mitigate them. Some common biases to be mindful of include overconfidence, anchoring, and loss aversion.

Rely on the compounding effect

Munger strongly advocates for the potency of compound interest, famously referring to it as the “eighth wonder of the world”. The essential strategy for wealth accumulation is to initiate investments early and allow your money to accrue over time. Avoid getting entangled in the market’s short-term fluctuations.

Be always willing to learn

Munger is an avid reader and a lifelong enthusiast for learning. He underscores the significance of continually broadening one’s knowledge and comprehension of the world, asserting that this practice not only enhances one’s skills as an investor but also contributes to personal growth.

Munger’s diverse interests are reflected in Berkshire’s portfolio, which spans a wide range of businesses, encompassing information technology companies to those engaged in the manufacturing and marketing of candies and peanut brittle.